If you’ve used Minea, you already know it has real advantages, especially for spotting trends early. But like any ad spy tool, it also comes with limitations, such as gaps in ad coverage or data depth that can make validation slower and less consistent than you’d like.

That’s why many dropshippers look for alternatives that improve on what Minea offers. Some tools broaden platform tracking, others sharpen ad analytics, and a few add the automation layer that growing stores rely on. For example, AutoDS bundles ad insights and store automation into one connected ecosystem.

So, to make your decision clearer, this guide walks you through the top Minea alternatives and how they differ across research accuracy, ease of use, automation, and scalability, helping you choose the one that fits your workflow and growth goals best.

Minea remains a solid ad spy tool, but it focuses mainly on ads and influencer tracking without covering execution or fulfillment.

The best Minea alternatives go beyond ad discovery, combining product validation, supplier data, and automation to turn trends into sellable products.

Automation is the key differentiator in 2026, as importing, price monitoring, stock sync, and order fulfillment determine how fast and safely stores can scale.

AutoDS stands out as the most complete alternative, merging ad spy features, real sales-based product research, supplier insights, and full store automation in one platform.

Different tools fit different needs, but sellers looking to research, validate, and scale from one dashboard benefit most from an all-in-one solution rather than stacking multiple tools.

For dropshippers focused on long-term growth, AutoDS offers a unified workflow that replaces Minea while eliminating the operational gaps most ad spy tools leave behind.

What Is Minea and Why Dropshippers Look for Alternatives

Minea is an ad spy platform built to help dropshipping businesses discover winning products by tracking ads, creatives, and influencer activity across multiple social networks. In simple terms, it shows you what’s trending, who’s promoting it, and how competitors are running their campaigns, so you can validate ideas faster and catch early momentum.

To its credit, Minea does a few things really well, especially for sellers who love digging into creative data and social proof. Its main strengths include:

✅️ A large and diverse creative library that lets you spot angles, hooks, and ad formats your competitors use before they take off.

✅️ Influencer insights showing which creators are pushing specific products, how often they promote them, and how audiences engage.

✅️ Competitor tracking tools that reveal what other stores are testing, scaling, or quietly dropping; useful for pattern recognition.

At the same time, Minea isn’t perfect. Several limitations push users to look around for more complete or scalable solutions:

🚨 No built-in automation, which means you can’t import products, automate orders, or streamline fulfillment directly from the platform—everything becomes a multi-tool workflow.

🚨 No product importing or fulfillment features, leaving you to manually bridge the gap between finding a potential winner and actually launching it in your store.

🚨 Limited supplier data, so while you can see an ad is performing, you still need external research to confirm pricing, profit margins, delivery times, and stock availability.

🚨 Higher costs for full access, especially if you want broad ad coverage and influencer data, making it harder for beginners or small teams to justify long-term.

🚨 A steeper learning curve, as the interface and data depth can feel overwhelming until you build a routine.

🚨 Data gaps outside certain niches, meaning some product categories feel thin or inconsistent, which slows down validation.

With this mix of strengths and limitations, it’s natural for dropshippers to explore alternatives, especially those that combine ad insights with automation, sourcing, and store management.

Criteria for Choosing a Minea Alternative

When you’re comparing Minea alternatives, the real goal is choosing a platform that strengthens product research, speeds up decision-making, and supports your store as it scales. These are the criteria that actually matter:

Product research depth & trend detection

Your tool should go beyond surface-level signals and help you understand momentum, saturation, and lifecycle. The deeper the trend data, the faster you can validate winners and avoid products that are already fading out.

Ad library & creative insights

A strong alternative needs a diverse, regularly updated ad library that shows engagement metrics, creative breakdowns, and audience reactions. This helps you reverse-engineer why certain ads scale and build your own winning angles.

Competitor store monitoring

Look for features that reveal competitor bestsellers, new launches, pricing strategies, and scaling patterns. The goal is to monitor the market in real time, so you’re never guessing whether a product still has demand.

Supplier data & profitability insights

Winning products mean nothing without healthy margins. A good research tool should connect products to suppliers, compare costs, highlight shipping variations, and estimate profit so you make decisions based on numbers, not instinct.

Automation capabilities (importing, pricing, fulfillment)

Minea doesn’t handle operations, so strong alternatives fill that gap. Automation tools should let you import products in one click, sync prices and stock, and fulfill orders automatically, saving hours each week while reducing manual errors.

Pricing & value for money

Ad spy tools can get expensive fast, especially when features are paywalled. Evaluate whether the platform actually boosts your revenue enough to justify the subscription, not just whether it looks feature-rich on paper.

Cross-platform support

If you sell on multiple channels, your research tool should support them. Cross-platform compatibility ensures your insights translate into opportunities, whether you’re scaling Shopify, testing eBay, or expanding to Amazon or Etsy.

With these criteria, you’ll quickly see which tools genuinely enhance your workflow, and which ones fall short once you start digging deeper.

Top Minea Alternatives (Complete List)

Now comes the fun part! Not every Minea alternative solves the same pain point: some dig deeper into ad analytics, others excel at competitor tracking, and a few blend research with full store automation. By knowing what each platform does best, you can pick the one that truly supports your workflow instead of hopping between tools that don’t deliver. Here are the top options worth your attention:

AutoDS

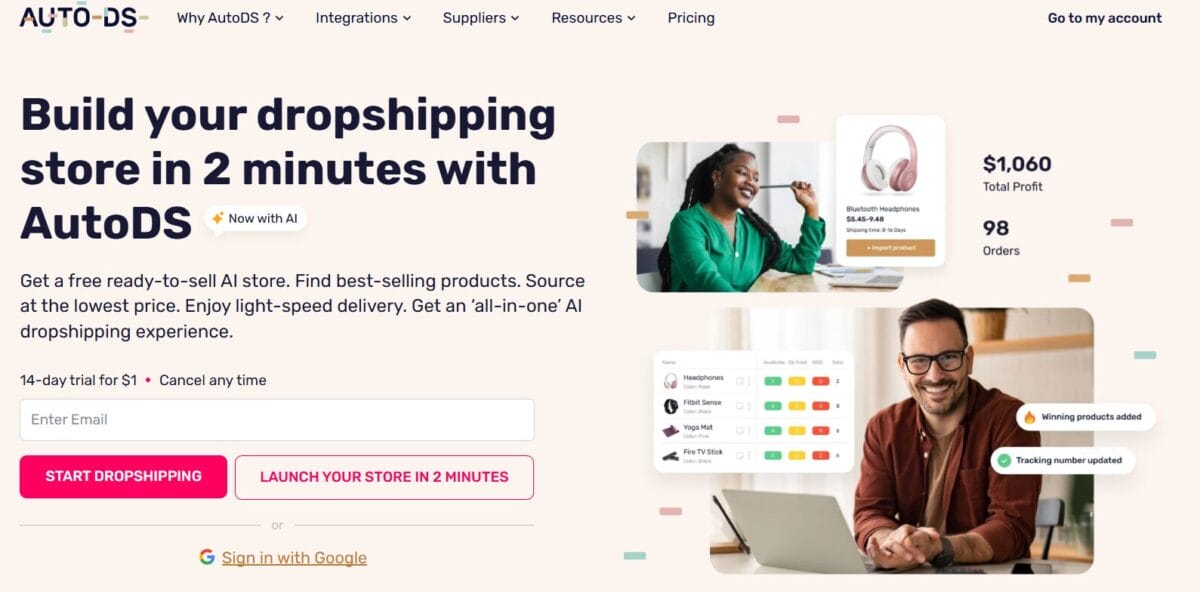

AutoDS stands out as the best all-in-one Minea alternative because it does more than just help you spot winning products: it helps you sell them, automate them, and scale them. While Minea is strong in creative tracking and influencer discovery, it stops short of the execution layer. AutoDS fills that gap by combining ad insights, product validation, supplier data, and full store automation in one connected system.

As part of its research features (trending products section, Hand-Picked Products, and the AutoDS Winning Products Hub), every item comes with AI-backed analytics, trend indicators, competitor listings, supplier options, and profitability metrics. Instead of piecing together information from several tools, you get a fully validated product you can import directly into your store with one click.

Additionally, AutoDS offers powerful Ads Spy Tools that let you analyze trending ads across TikTok, Facebook, and Instagram in real time. With advanced filters—such as likes, impressions, interaction rates, CTA text, and keywords—you can uncover high-performing creatives, understand what messaging resonates, and gather inspiration to test products and angles faster, all without switching between platforms.

From here on, AutoDS pulls ahead through the features Minea doesn’t offer, but dropshippers need to operate efficiently. Here are the core capabilities that make the platform the most complete solution:

⭐ Automation: AutoDS automatically imports products (including images, variants, specs, and optimized descriptions) to Shopify, eBay, Amazon, Facebook Marketplace, Etsy, and Wix. Once live, AutoDS adjusts prices based on custom rules, updates stock in real time across multiple suppliers, and prevents overselling. For example, if a supplier raises prices or runs out of stock, AutoDS updates your store instantly. No manual monitoring needed.

⭐ Multi-supplier support: Unlike Minea, which focuses mainly on ad discovery, AutoDS connects you with a vast supplier network: US and EU fast-shipping suppliers, wholesale catalogs, Chinese suppliers, print-on-demand partners, and the AutoDS private supplier marketplace. This gives you broader sourcing options, better pricing, and richer profitability data.

⭐ Full fulfillment automation: AutoDS handles orders for you through automatic orders or the fully hands-off Fulfilled by AutoDS system. This removes late-night ordering, supplier juggling, and manual tracking updates. AutoDS even sends tracking numbers back to your selling channel automatically to protect your account metrics.

⭐ Cross-platform support: Where Minea is primarily a research tool, AutoDS supports your full business across platforms. You can research on AutoDS, import to Shopify, list on eBay, fulfill orders from Amazon, and manage everything from one dashboard. For multichannel sellers, this creates the unified system Minea simply doesn’t offer.

In summary, AutoDS ties research, importing, automation, fulfillment, customer messaging, and analytics into a single connected workflow. It’s not just a Minea alternative: it’s the tool sellers use once they’re ready to scale.

💬 As online business expert Baddie In Business points out: “AutoDS gives you tools to research product data, check profit margins, see competitors, spy on trending ads, automate pricing, and manage orders automatically.” Want to see it in action? Try AutoDS for just $1 and experience it yourself.

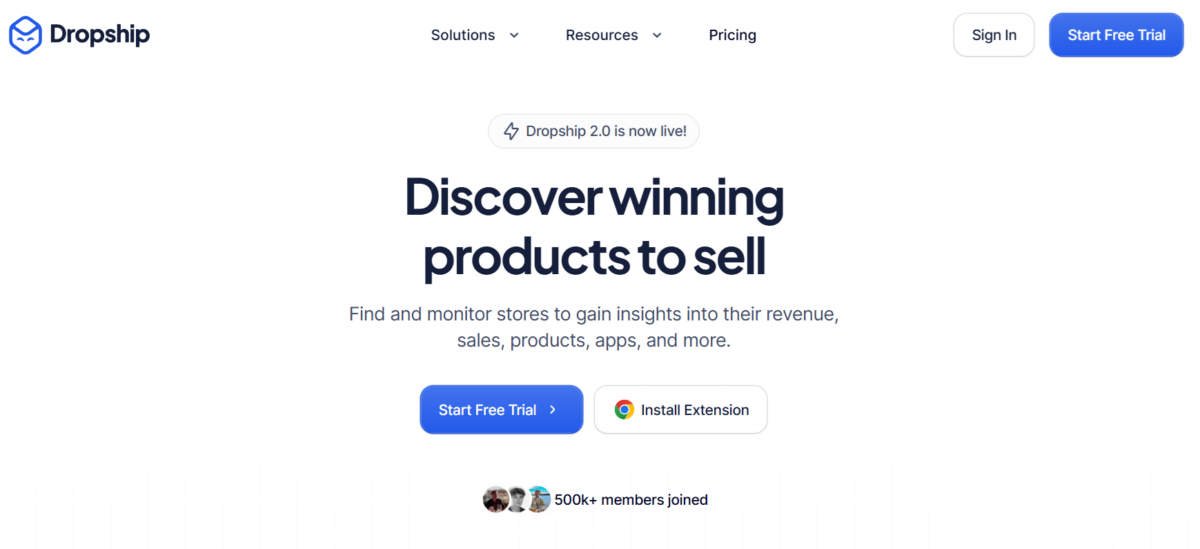

Dropship.io

Dropship.io is a useful option for sellers who prioritize competitor analysis and market visibility. It focuses on showing what other stores are selling, how their catalogs evolve, and which niches are gaining traction, making it a practical tool for early-stage product and niche research.

Its main strengths sit firmly on the research side:

✅️ Competitor and store analysis: Provides visibility into store performance, estimated sales, growth patterns, and niche activity.

✅️ Search-based product discovery: Allows filtering products by keywords, sales estimates, and related items.

✅️ Market trend signals: Helps identify product and niche movement based on store-level data rather than ad performance alone.

However, several limitations appear once sellers move beyond pure research:

❌ No automation: There’s no product importing, price monitoring, inventory syncing, or order management, meaning every next step requires external tools and manual work.

❌ Limited supplier connection: Dropship.io doesn’t offer direct access to shipping data or alternative sourcing options.

❌ Restricted ad intelligence: While helpful for store-based insights, its ad tracking capabilities are far more limited than those of dedicated ad spy platforms.

As a result, Dropship.io works best as a standalone research layer. Dropshippers who want to connect product discovery directly to supplier data, automation, and multichannel execution often look toward platforms like AutoDS, where insights naturally evolve into scalable operations.

Sell The Trend

Sell The Trend combines a video-focused ad library with product and trend discovery, offering a visually driven way to see what’s gaining traction across social platforms. Its interface is approachable, and the emphasis on curated insights makes it appealing for sellers who prefer inspiration-first research.

Its strengths revolve around idea discovery:

✅️ It highlights popular video creatives, making it easier to spot patterns in messaging, formats, and hooks.

✅️ It surfaces early-moving products before they reach peak saturation.

Still, that focus on inspiration also comes with a few trade-offs:

❌ Sell The Trend doesn’t support product importing, repricing rules, inventory syncing, or order automation.

❌ Supplier data remains limited, with no built-in sourcing diversity or fulfillment workflows.

❌ Turning ideas into live listings depends on external tools and manual coordination.

Overall, Sell The Trend serves mainly as an inspiration and validation layer, especially for newer sellers. But for dropshippers looking to connect research directly to suppliers, more comprehensive platforms like AutoDS tend to offer a smoother path to scale.

PiPiADS

PiPiADS focuses almost exclusively on TikTok ad intelligence, making it a popular choice for dropshippers building traffic around short-form, viral content.

✅️ Its database tracks millions of TikTok ads and creators, giving clear visibility into what’s trending across niches, regions, and engagement levels.

✅️ Influencer-tracking tools make it easier to identify high-performing creatives and spot emerging promotional trends early.

That same strength also defines its ceiling:

❌ PiPiADS is limited to TikTok, with no cross-platform ad tracking for Facebook, Instagram, or other channels.

❌ It doesn’t provide product validation, supplier insights, or real marketplace performance data.

❌ There are no importing, pricing, inventory syncing, or fulfillment automation features to support execution.

In short, PiPiADS is practical for TikTok-first strategies centered on creative testing and influencer discovery, but it can feel restrictive for sellers who need broader research and operational tools as they scale.

📦 Supplier’s Tip: Speaking of the devil — are you interested in getting into TikTok dropshipping? Before you dive in, check out our guide for TikTok dropshipping suppliers and make sure you’re working with sources that support fast shipping, reliable stock, and platform-compatible fulfillment.

AdSpy

AdSpy is one of the most established ad databases for Facebook and Instagram, widely used by marketers who want deep visibility into creative performance. Its extensive filtering options allow users to analyze ads by visuals, copy, engagement signals, landing pages, and targeting angles, making it a solid resource for understanding competitor positioning and messaging.

It offers:

✅️ Broad Facebook and Instagram ad library with years of historical creative data.

✅️ Strong visibility into competitor ad strategies and messaging frameworks.

🔍 Research Tip: Is Instagram still a thing? Yes, it is. And with AutoDS’s Instagram Ads Spy Tool, you can track high-performing creatives, analyze engagement signals, and uncover product trends that are still scaling quietly before they hit saturation.

That depth, however, comes with trade-offs (both strategic and financial):

❌ AdSpy is one of the more expensive tools in this category, which can be hard to justify for sellers focused on ecommerce execution rather than pure ad research.

❌ The platform is built around creatives only, with no ecommerce-ready product insight, validation metrics, or sales performance context.

❌ Turning ad insights into live products requires multiple additional tools and manual workflows.

In practice, AdSpy is best suited for users who prioritize raw ad intelligence and already operate with a broader tool stack. Compared to more complete solutions like AutoDS, it often feels like only one piece of a much larger puzzle.

BigSpy

BigSpy positions itself as a budget-friendly ad tracking tool for sellers who want broad creative exposure without committing to premium pricing. It monitors ads across Facebook, TikTok, Pinterest, YouTube, and others, helping identify cross-platform creative trends.

Its strengths are centered on accessible creative discovery:

✅️ Multi-platform ad tracking across major social networks within a single dashboard.

✅️ Straightforward ranking and filtering scheme that surfaces trending creatives by niche, format, and engagement signals.

That said, BigSpy remains firmly at the entry level of research:

❌ It focuses exclusively on ads, without visibility into product performance, real sales data, or profitability indicators.

❌ There’s no sourcing context or inventory insight to support confident product decisions.

❌ It doesn’t include importing, pricing, or automation features.

Overall, BigSpy makes the most sense for sellers seeking affordable creative inspiration across multiple platforms, but it offers limited depth when it comes to product validation and operational execution.

EcomHunt

EcomHunt centers its value around curated product research, making it especially appealing for sellers who want fast inspiration without diving deep into raw data. Its pros lean toward simplicity and ease of use:

✅️ Curated product lists with trend scores and basic demand signals, ideal for quick idea generation.

✅️ Suggested pricing ranges and entry-level competitor insights to help assess viability at a glance.

✅️ An intuitive interface that reduces friction for sellers new to product research.

That simplicity, nonetheless, also defines its cons:

❌ Ad analysis is fairly basic, with no deep creative tracking or multi-platform ad intelligence.

❌ There’s no built-in automation for importing, pricing, inventory syncing, or fulfillment.

❌ Profitability insights remain surface-level, without real sales data.

EcomHunt works well as a starting point for product discovery and trend awareness, but for advanced dropshippers, it’s too basic to support their next stage of growth.

Dropship Rabbit

Dropship Rabbit takes a very straightforward approach to product research, focusing on niche-based browsing and simplified supplier snapshots. It’s designed for sellers who want to explore product categories quickly, making it useful for discovering less saturated categories or gathering catalog-style inspiration without a steep learning curve:

✅️ Niche-focused product lists that make it easy to browse ideas by category.

✅️ A lightweight interface suited for fast exploration rather than deep analysis.

That simplicity also defines its constraints:

❌ There’s no ad spy functionality to analyze creatives, trends, or competitor campaigns.

❌ Basic supplier references.

❌ Product validation is minimal, with no sales data, engagement metrics, or profitability indicators.

❌ It lacks automation entirely.

In general, Dropship Rabbit serves as a low-friction idea discovery tool for early exploration. Those aiming to connect products directly to suppliers and scale through automation typically need more robust platforms to support growth beyond the research phase.

Koala Inspector

Koala Inspector specializes in Shopify competitor store analysis, making it a go-to tool for sellers who want to reverse-engineer successful stores. Its value is centered on competitive visibility:

✅️ In-depth Shopify store analysis, including themes, apps, and catalog structure.

✅️ Insights into pricing strategies and product positioning across niches.

✅️ Useful indicators for identifying potential suppliers and operational setups.

Where Koala Inspector draws a clear boundary is beyond store analysis:

❌ There’s no ad or creative tracking across Facebook, TikTok, or other platforms.

❌ It doesn’t surface trend data, product demand signals, or validation metrics.

❌ There are no automation, importing, pricing, or fulfillment features.

Koala Inspector finds its strongest use as a competitor intelligence layer rather than a standalone research solution.

Comparison Table — Minea vs Top Alternatives

| Tool | Ad Spy Features | Product Research | Store Analysis | Supplier Data | Automation | Price | Best For |

|---|---|---|---|---|---|---|---|

| AutoDS | Multi-platform (Facebook, Instagram & TikTok) | Complete research ecosystem | Excellent | Multi-supplier network | Full automation | $19.90/mo | All-in-one dropshipping |

| Minea | Multi-platform + influencer tracking | Basic trend/product clues | Limited | Minimal | None | $49/mo | Users focused on creatives & influencers |

| Dropship.io | Limited Search-based, data-heavy discovery Limited Limited None $19/mo Competitor-focused researchers | Search-based, data-heavy discovery | Limited | Limited | None | $19/mo | Competitor-focused researchers |

| Sell The Trend | Video ad library | Trend explorer + curated picks | Basic | Limited | Minimal | $29.97/mo | Trend spotting |

| PiPiADS | TikTok-focused | Limited | Basic | Minimal | None | $49/mo | TikTok-ads |

| AdSpy | Huge FB/IG ad archive | Limited | Basic | None | None | $149/mo | Users needing raw ad data |

| BigSpy | Multiplatform | Limited | Basic | None | None | $9/mo | Beginners |

| EcomHunt | Limited | Curated lists + trend scores | Basic | None | None | $29/mo | Beginners |

| Dropship Rabbit | None | Limited | Basic | Basic | None | $14.99/mo | Beginners |

| Koala Inspector | Limited | Minimal | Strong Shopify store intel | None | None | $15.99/mo | Shopify competitor analysis |

Why AutoDS Is the Best Minea Alternative

What makes AutoDS the strongest Minea alternative is its ability to close the gap between finding a product and actually selling it. Minea does a solid job at creative tracking, but AutoDS builds on that foundation with real sales data, deeper validation, and end-to-end automation that removes manual work entirely.

At its core, AutoDS includes a built-in product research ecosystem powered by real marketplace performance. The Winning Product Hub moves beyond traditional ad libraries by combining engagement metrics, supplier options, and profit calculations in one place—turning raw ideas into fully validated products. On top of that, AutoDS pulls insights from multiple ad-sourcing channels, including Facebook, TikTok, Instagram, and viral product data, allowing sellers to analyze trends from several angles instead of relying on a single signal.

The real advantage becomes clear at the execution stage. With one click, AutoDS lets you import products complete with descriptions, variants, and media, while tracking supplier stock in real time and adjusting prices automatically to protect margins. Fulfillment automation takes care of ordering, tracking updates, delivery confirmations, and metric protection—all without jumping between dashboards. And unlike tools that focus mainly on Shopify, AutoDS supports eBay, Amazon, Etsy, Facebook Marketplace, and more, giving multichannel sellers room to scale without friction.

Just as importantly, this all-in-one approach is more cost-effective than stacking separate research tools, ad spy platforms, and fulfillment systems. By centralizing everything into one connected workflow, AutoDS delivers more control with far less operational complexity.

Ultimately, the difference comes down to scope. Minea is designed to help sellers research ad trends, while AutoDS functions as a complete growth solution that combines ad insights, product research, supplier networks, and full store automation. In practical terms, AutoDS helps sellers discover products, validate them with confidence, and scale them efficiently, while most alternatives remain focused on discovery alone.

And that’s the core distinction: AutoDS unifies research, automation, and fulfillment in a single platform that Minea simply doesn’t cover.

Frequently Asked Questions

What is the best Minea alternative in 2026?

The best Minea alternative in 2026 is AutoDS, because it goes beyond ad discovery. It unifies research, sourcing, and automation into a single environment, so sellers can go from idea to live listing in one continuous flow. This way, it eliminates the need to jump between disconnected tools.

Does AutoDS offer ad spy features like Minea?

AutoDS offers robust ad spy features similar to Minea, covering Facebook, Instagram, and TikTok. It tracks top-performing creatives, engagement rates, and trending products, while letting users search by keywords, filter by likes or impressions, and analyze competitor strategies directly. What sets it apart is how research insights translate instantly into automated actions and verified sourcing paths.

Can I find winning products without Minea?

You can find winning products without Minea using tools built around sales data and validation. AutoDS’s built-in product research features scan millions of items daily from suppliers and top stores, surfacing products with proven demand. While tools like EcomHunt, Dropship.io, and Sell The Trend also spot trends, AutoDS excels by converting those insights into actionable listings.

What’s the cheapest Minea alternative?

The cheapest Minea alternative depends on features, but tools like BigSpy or EcomHunt offer lower entry prices. However, AutoDS often delivers better value by replacing multiple tools subscriptions with one platform that covers research, ads, suppliers, and automation under one roof.

Is Minea still worth it for ad research?

Minea is still worth it for ad research if your main focus is creative tracking and influencer ads. That said, dropshippers who want automation, supplier data, and execution tools often outgrow Minea quickly, opting for more comprehensive solutions, such as AutoDS.

Which Minea alternative gives both ad data + supplier data?

The Minea alternative that provides both ad data and supplier data is AutoDS. It connects winning ads directly to vetted suppliers, shipping times, pricing, and profit margins, making it easier to evaluate whether a product is truly scalable.

Do any Minea competitors offer automation?

Some Minea competitors offer limited automation, but AutoDS delivers full operational automation. From importing products to price monitoring, stock syncing, and order fulfillment, it replaces manual backend work that ad spy–only tools don’t address.

What tools replace Minea’s influencer research features?

Tools that replace Minea’s influencer research features include AutoDS’s Ads Spy Tools and PiPiADS. AutoDS extends influencer insights further by validating products through engagement data, supplier availability, and real marketplace performance.

Can I use multiple Minea alternatives together?

You can use multiple Minea alternatives together, such as combining an ad spy tool with a fulfillment platform. However, many dropshippers prefer AutoDS because it consolidates research, supplier sourcing, and automation into one unified system.

Which alternative is best for viral TikTok product research?

The best alternative for viral TikTok product research is AutoDS, thanks to its dedicated TikTok Ads Spy Tool. It tracks viral creatives, engagement spikes, and product momentum, while linking those insights directly to suppliers and automated importing for faster execution.

Find Winning Products Faster With AutoDS

At this point, the takeaway is clear: ad discovery alone is no longer enough to build a scalable dropshipping business. Tools like Minea are useful for spotting creative ideas, but long-term success depends on deeper validation and the ability to transform insights into real execution. That’s where AutoDS clearly sets itself apart.

AutoDS brings ad spying, product research, supplier insights, and store automation together in one connected platform. Instead of stopping at “this ad looks promising,” it shows whether a product is actually selling, how strong the margins are, and how smoothly fulfillment can be handled, all before you commit.

The platform also adapts naturally to different stages of growth:

- Beginners benefit from hand-picked products and guided workflows that reduce costly mistakes.

- Expanding stores gain speed, margin control, and multichannel expansion tools.

- Advanced dropshippers use ad intelligence, supplier diversification, and automation to scale without operational friction.

So if you’re ready to move beyond ad discovery and build a system designed to turn research into revenue, you already know which option is the smartest.

📈 Try AutoDS with a 14-day trial for just $1 and start finding, validating, and scaling winning products faster, without the complexity.

Curious to learn more? Dive into these related articles and keep building your dropshipping expertise: