Finding profitable products on Amazon in 2026 is a challenge, not gonna lie! Endless scrolling, winging it with trends, and chasing random “hot items” usually lead to wasted time and disappointing results. In 2026, the “just pick a product and hope for the best” era is officially over.

The real wins now come from spotting trending niches, not guessing. Amazon’s search volume shifts, intent-based keywords, and early customer patterns tell a story long before a niche goes mainstream. Once you understand how those indicators connect, product research stops feeling like chaos and starts feeling like strategy.

This is where automation steps in. AutoDS helps Amazon sellers analyze niches faster with real-time data, turning scattered signals into clear opportunities. So, let’s make this simple: in this guide, you’ll learn how Amazon product research actually works today, which tools deserve your attention, and how to build a niche-finding workflow that consistently pays off.

Amazon product research relies on a structured workflow that blends data, validation, and automation to minimize guesswork and detect winning niches.

Key data points—pricing thresholds, review patterns, sales velocity, and seasonality—help reveal which niches on Amazon offer consistent profitability.

The right tools for Amazon product research, like AutoDS, make it easier to spot trends, assess demand, and analyze competitors with greater accuracy.

Evergreen and seasonal niches—from fitness and pet care to outdoor and holiday items—offer predictable demand patterns when timed and positioned correctly.

Common pitfalls include chasing saturated products, ignoring supplier reliability, and overlooking long-term demand signals; advanced tactics focus on clustering niches, validating suppliers, and leveraging automation for consistent scale.

Automation with AutoDS streamlines Amazon product research, removes repetitive tasks, and enables scalable, data-driven decision-making.

What Is Amazon Product Research?

At its core, Amazon product research is simply the art of figuring out what people actually want to buy using data analysis, not guesswork. It means looking at demand trends, competition levels, pricing patterns, and customer behavior to spot products with genuine potential. Instead of rolling the dice on a “maybe,” you’re making decisions backed by numbers and buyer intent.

But here’s where it gets interesting: product research isn’t the same as niche research. Product research asks, “Is this item worth selling?”, while niche research asks, “Is there a whole category of buyers with multiple opportunities hiding inside it?” In 2026, most winning sellers lean toward niche research because it reveals product clusters, not one-hit wonders.

The approach also shifts depending on how you sell:

- Amazon FBA sellers think in terms of fees, margins, and storage costs.

- FBM sellers obsess over shipping speeds and supplier reliability.

- Sellers focused on Amazon dropshipping chase high-demand, low-risk items that don’t require upfront stock.

Same marketplace, totally different angles.

🆕 Beginner’s Tip: If you’re wrapping your head around how FBA, FBM, and dropshipping differ, take a minute to read our guide on Amazon FBA vs. Dropshipping. It breaks down fees, logistics, and risk levels in plain language. Once you understand those differences, your product research becomes way clearer.

And yes, solid research is non-negotiable. Amazon is crowded, competitive, and brutally price-sensitive. Without good data, sellers fall into saturated markets, race to the bottom on pricing, or underestimate what customers expect (spoiler: it’s a lot).

Layer all that with Amazon’s ranking system (often called the A9/A10 algorithm), which pushes products that convert, satisfy search intent, and rack up positive reviews. Once you understand how Amazon decides what to show shoppers, research goes from feeling overwhelming to feeling like a strategic advantage.

How Amazon Trending Niches Work

What Is a “Trending Niche” on Amazon?

Let’s start with the basics. A trending niche on Amazon is more than “a category that sells a lot”: it’s a mini-ecosystem where demand starts climbing fast, competition hasn’t fully caught on, and shoppers keep dropping hints that they want more. Think of it as catching a wave before everyone else shows up with a surfboard.

A trending niche usually shows clear demand growth patterns: consistently rising search volume, more units sold month over month, and product variations popping up because shoppers are asking for them (directly or indirectly). The trick is recognizing whether that growth is real, sustained, and worth building a product strategy around.

Then comes the classic dilemma: seasonality vs. evergreen. Some niches explode every year (Halloween decor, pool accessories, winter jackets), while others perform steadily no matter the season (home office gear, kitchen storage, mobility accessories). A good product researcher knows when to ride the seasonal wave and when to invest in long-term categories that keep selling even when the trends cool down.

You also need to balance niche size vs. saturation. Bigger niches bring more visibility but also more heavyweight competitors with 5,000+ reviews. Smaller niches can be goldmines if they’re underserved, especially if customers are actively looking for specific variations or improvements. And don’t underestimate micro-niches: sometimes the real opportunity hides inside a tiny corner of a massive category, like “ergonomic left-handed peelers” inside kitchen tools.

How Trends Form on Amazon

Here’s where things get interesting. Amazon trends don’t form in a vacuum; they spill over from everywhere else shoppers spend their attention.

First, you’ve got social media influence, which is basically gasoline for niche growth. One TikTok cooking gadget goes viral, and suddenly search volume spikes overnight. Amazon’s algorithm picks up the signal, boosts the listings that convert the fastest, and boom: you’ve got a trend forming in real time.

Then there are search volume spikes driven by actual shopper curiosity. Sometimes the traffic comes from news cycles, sometimes from frustrations (“my dog chewed another bed”), and sometimes simply because a new product solves a problem better than the old ones.

Emerging lifestyle needs also reshape niches faster than people realize. Think about the rise of home fitness, daily hydration habits, remote work, eco-friendly cleaning, or mobility-friendly accessories for aging populations. When real life shifts, Amazon trends follow.

And of course, you can’t ignore disruptions — economic, cultural, or seasonal. Inflation changes what people prioritize. New hobbies become mainstream. Lifestyle “aesthetics” turn into full-blown purchasing patterns. Even a heatwave can temporarily catapult an obscure product to the front page.

The bottom line: trending niches aren’t “random.” They’re the result of attention, behavior, needs, and timing aligning, and Amazon’s ranking system amplifying what shoppers respond to the fastest.

Key Data Points for Finding Profitable Niches

Spotting profitable dropshipping niches on Amazon is like detective work. The clues are hiding in plain sight if you know where to look. Here are the data points smart sellers check before committing to a new niche (or running away from one):

1️⃣ Search Demand

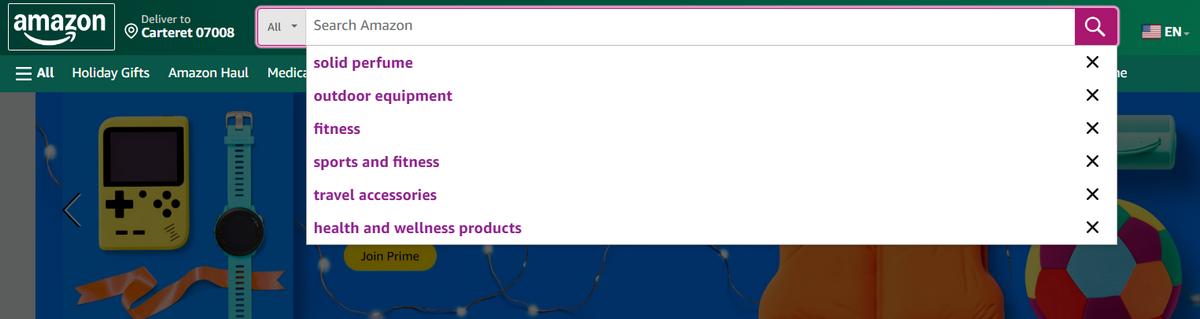

Start with the pulse of the marketplace: what people are actually typing. The Amazon search bar predictions alone can tell you a lot. When Amazon autocompletes with long-tail queries (“acupressure mat for beginners”, “dog water bottle hiking leak-proof”), that’s a real-time hint that shoppers are hungry for specific variations.

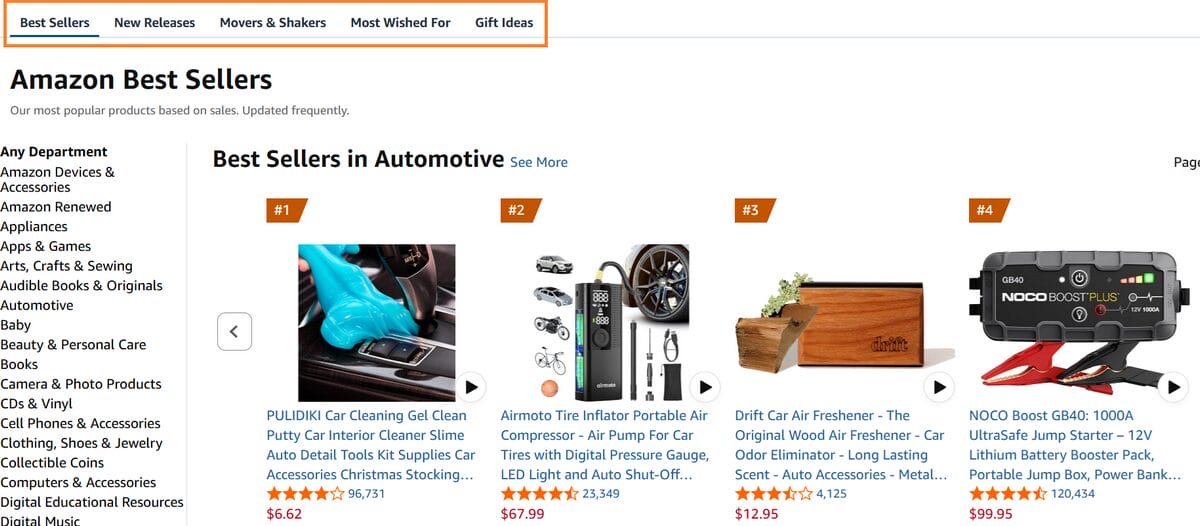

Then swing by Amazon Movers & Shakers, one of the fastest ways to catch demand surges before your competitors do. If a product category starts climbing quickly, it’s usually because something in shopper behavior or social media kicked it into high gear.

And for extra confidence, validate the trend externally with Google Trends. If Amazon searches rise but Google stays flat, you may be looking at a short-lived spike. But if both curves point upward? That’s a niche worth watching closely.

2️⃣ Competitor Analysis

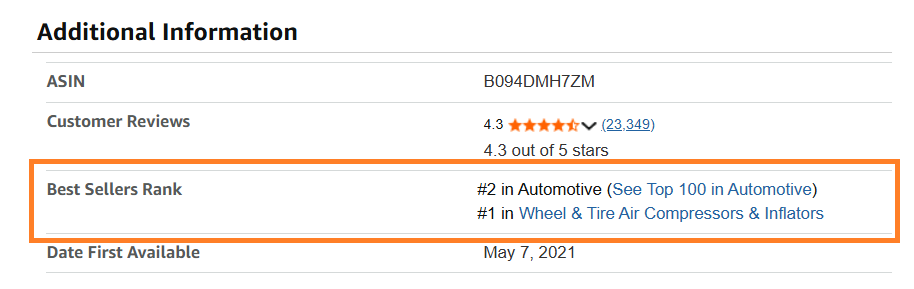

Next step: check who you’re up against. The BSR (Best Sellers Rank) helps you understand how fast items sell inside a category. Lower BSR = higher velocity, but context matters (a #500 in Kitchen is often more competitive than a #50 in Office Supplies).

Look closely at review counts and recency. Thousands of old reviews don’t scare niche hunters, but hundreds of fresh ones usually mean competition is heating up now. Mix that with listing quality signals (images, titles, keyword coverage), and you’ll know instantly whether your potential rivals are asleep at the wheel or playing championship-level eCommerce.

Finally, track price consistency. If top listings bounce up and down every week, sellers may be fighting margin wars (not ideal). A healthy niche usually has stable pricing in the top 10 results.

3️⃣ Profitability Indicators

A niche can look amazing… until you run the numbers. Start with margin estimation, factoring in Amazon’s referral fees, storage fees, FBA costs, or the operational reality of FBM. The margin that “looks great” on paper often shrinks once you calculate inbound shipping, prep, and packaging.

Knowing the Amazon fee structure for both FBA and FBM is crucial because each model affects your final profit differently. FBA gives you convenience and Prime eligibility, but you pay for speed and logistics. FBM keeps your costs flexible, but you depend heavily on your supplier’s fulfillment quality.

Which brings us to cost control. A niche only works if you can source competitively, so keep a close eye on supplier pricing, especially shipping costs.

4️⃣ Supply Chain Health

Even the best niche collapses if the supply chain can’t keep up. Start by checking delivery time: long delivery windows reduce conversions and kill your Buy Box chances.

Then evaluate inventory stability. If the top-selling listings keep running out of stock, that might mean suppliers are struggling. Sometimes that’s a red flag, other times it’s a huge opportunity to grab demand while competitors scramble.

And don’t skip the basics: brand ownership and IP safety. If a category is dominated by branded products or items with patented features, you don’t want to accidentally step into legal quicksand. A healthy niche gives you space to innovate without triggering takedowns.

Best Tools for Amazon Product & Niche Research

To dive into the right niches, you need the right tools, the kind that cut through noise, surface real data, and help you make decisions with confidence. Let’s break down the ones worth your time:

AutoDS Product Research Tools

AutoDS is an all-in-one finding tool built for Amazon sellers who want speed, clarity, and reliable data without switching between five different tools. Each feature works together to help you find real opportunities, validate them, and move into execution with confidence.

AutoDS Marketplace: A curated catalog of ready-to-sell products sourced from vetted suppliers. You can filter by price, category, shipping speed, reviews, and profit potential, giving you a fast, structured way to surface niche-worthy products without digging through thousands of listings manually.

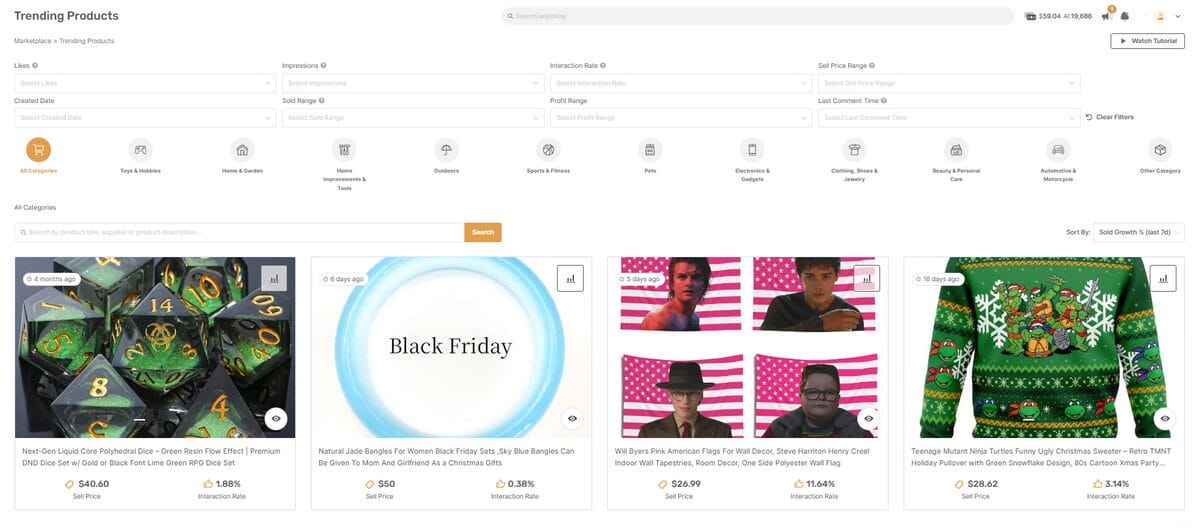

Trending Products Section: A real-time radar for items gaining momentum across marketplaces. This is where you detect demand early, thanks to signals like rising sales velocity, platform activity, and emerging keyword clusters.

Hand-Picked Products Section: Expert-curated selections of products chosen for their demand indicators, unique positioning, and profitability potential. Ideal for beginners who want pre-validated ideas or for experienced sellers looking for inspiration without doing a full research cycle from scratch.

Ads Spy Tools: A window into what top competitors are actively promoting across social media. They let you analyze creatives, engagement levels, ad angles, and listing structures to see which products are gaining paid traction. Perfect for validating whether a trend has real commercial momentum rather than just social buzz.

One-Click Import to Amazon: Once you validate a niche or product, you can push it directly into your Amazon workflow with optimized settings, automated price/stock monitoring, and fulfillment rules. This turns research insights into live listings in minutes, not hours.

💬 As eCommerce entrepreneur Baddie In Business puts it: “AutoDS is a fulfillment center AND a product research app, so we are able to do everything through here.”

In short, the platform turns product research from a messy guessing game into a clear, data-driven system.

Amazon Native Tools

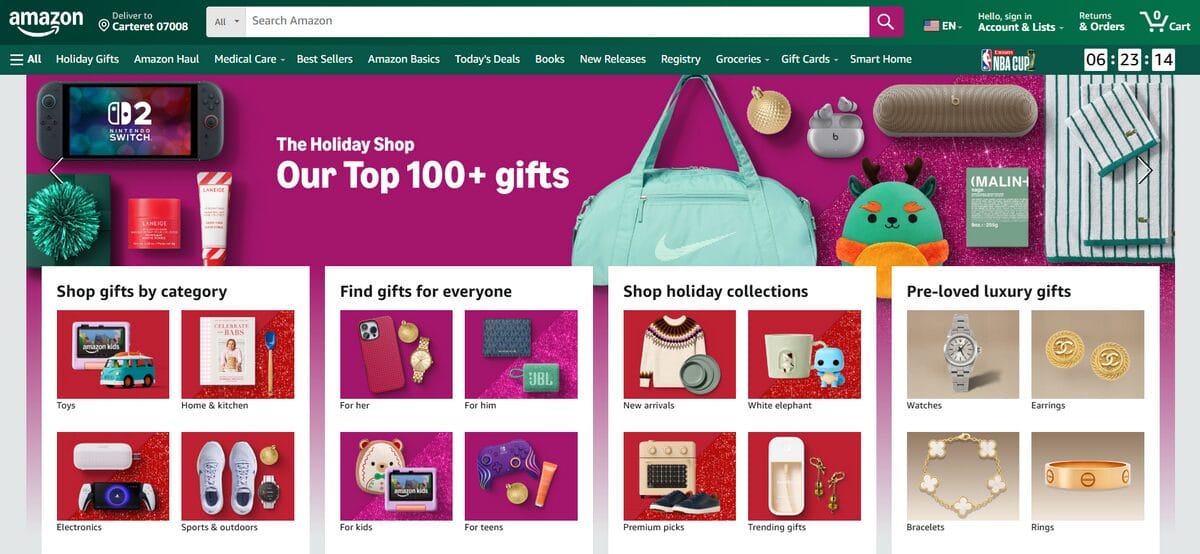

Amazon offers a surprising amount of first-party data within the platform. These built-in tools and sections are free, fast, and incredibly powerful for spotting early trends and understanding what real shoppers are searching for. Here are the ones worth paying attention to:

- Amazon Best Sellers: A live snapshot of what’s selling the most across every category. Great for spotting evergreen demand and understanding which niches consistently hold volume.

- New Releases: This section highlights products gaining traction fast. It’s one of the best places to identify emerging niches before they land on everyone’s radar.

- Movers & Shakers: Think of it as Amazon’s heat meter. It tracks items with sudden ranking jumps, giving you early clues about niches experiencing fresh demand spikes.

- Product Opportunity Explorer: A data-rich tool inside Seller Central that reveals niche demand, search growth, seasonality, top products, competitiveness, and customer needs. It’s perfect for validating niche sustainability, not just short-term buzz.

- Search Terms Report (for sellers): If you’re already selling, this report shows real customer queries tied to your listings. It’s gold for discovering adjacent niches, unexpected keyword patterns, and intent signals that can shape your next research move.

Other third-party Tools

Beyond native Amazon data, several external platforms can help validate trends, track competitors, and surface niches that aren’t obvious at first glance. These tools don’t replace Amazon Insights. In any case, they amplify them, giving you a wider lens on demand, saturation, and product momentum.

- AMZ Tracker: Known for competitor tracking, keyword monitoring, and listing health analysis. It’s especially useful for spotting when a competitor gains traction, loses ranking, or opens a gap in the niche you can capitalize on.

- Jungle Scout: One of the most popular research suites, offering sales estimates, keyword research, historical trend data, and supplier directories. Great for validating whether a niche has staying power and understanding seasonality.

- Helium 10: A powerhouse for keyword intelligence and product validation. Its tools reveal search demand surges, competitive density, PPC difficulty, and niche depth, ideal for avoiding markets that look good on the surface but collapse under pressure.

Step-by-Step: How to Find Trending Amazon Niches With AutoDS

Once your tools are in place, spotting trending Amazon niches comes down to following a clear, consistent workflow that ties together data, validation, and automation.

Step 1 — Start With AutoDS Product Research Tools

Before anything else, you need a solid starting point. And that means surfacing products and niches that are already showing momentum. AutoDS makes this easier by using real-time marketplace signals to highlight trends automatically.

Inside the Trending Products section, you’ll see items gaining traction based on demand growth, platform activity, and competitive patterns. Instead of scrolling blindly through Amazon, you begin with a curated list of products that point toward potential niches.

Look for items with rising velocity rather than just high volume; the former signals momentum, the latter can mean entrenched competition. Use filters (price range, shipping time, supplier region) to narrow down to products that fit your business model and margins.

🆕 Beginner’s Tip: Save your candidates into a shortlist inside AutoDS so you can compare them side-by-side (demand, supplier options, estimated profit) before committing to deeper validation.

Step 2 — Validate Search Demand

A niche only works if people are actually looking for it.

Type top keywords into Amazon autocomplete to see realistic shopper queries and long-tail variants. Then paste the main terms into Google Trends to confirm whether interest is growing, seasonal, or flat. If autocomplete shows specific, repeated variants and Google Trends confirms upward movement, that’s a solid demand signal.

✅️ Mini-check: if Amazon shows multiple “people also searched for” suggestions for the same intent, that means shoppers are exploring variations (good for building micro-niche bundles or differentiated listings).

Step 3 — Check Competition Levels

Demand is great, but not if the competition is stacked with giant brands and thousands of reviews. Here’s where you judge whether you can realistically enter the niche.

Look at:

- Review counts (under 500 often means you can still compete)

- Content quality: weak photos, messy titles, missing keywords

- Price consistency: erratic pricing often signals unstable sellers

If top listings look sloppy or underserved, that’s a niche with room for better execution: your opportunity.

Step 4 — Analyze Profit Margins

Even the best niche is useless if the margins don’t work. This step prevents you from chasing high-demand categories with razor-thin profit.

Estimate your costs using:

- FBA vs. FBM fee calculations

- Packaging and dimensional weight considerations

- Supplier cost compared to Amazon retail price

Don’t forget variable costs: returns rate, PPC spend to get initial velocity, and seasonal storage fees if using FBA.

Example: if the supplier cost is $8, the expected retail price $29.99, and Amazon + FBA fees + shipping + ads eat 45%, your net margin needs to be high enough to cover promotions and still leave a gain.

This exercise gives you a clear picture of whether the niche generates sustainable profit, not just revenue.

Step 5 — Deep Dive Into Micro-Niches

The best opportunities often live inside bigger categories. Micro-niches have specific intent, lower competition, and customers willing to pay premium prices.

From your shortlisted product, extract long-tail variations and use them as testing hypotheses (e.g., “pet grooming” → “cat deshedding brush XL hypoallergenic”). For each variant, re-check demand and competition using the same signals. Sometimes, a 10% tweak in features or audience targeting drastically reduces competition while keeping intent high.

Evaluate these micro-niches for seasonality, keyword variations, and long-term stability. This helps you avoid categories that trend for a month and then disappear.

Step 6 — Vet Suppliers

Great niche, solid margins —now make sure you can actually fulfill orders reliably. That’s where strong supplier vetting becomes key.

Look for sources with:

- Fast shipping and accurate ETAs

- Positive historical reviews

- Consistent stock availability

- No IP or brand ownership concerns

AutoDS connects you with Amazon dropshipping suppliers that meet these standards and lets you manage them all from a single dashboard. So you get one unified place to compare options, verify stock, monitor delivery times, and keep your supply chain clean.

💡 Pro Tip: Order a sample or use a small test order to measure real shipping time and product quality. Nothing replaces the firsthand test for avoiding costly surprises.

Step 7 — Import & Track Products Using AutoDS

Here’s where everything comes together. Once you confirm demand, competition, margins, and supply, it’s time to move into execution. And AutoDS makes this part effortless.

The platform handles the operational side that normally eats up hours:

- One-click product importing adds your researched product directly into your Amazon workflow.

- Automated price & stock monitoring ensures you never sell out-of-stock products or lose profit because a supplier changed their price.

- Auto-ordering and synced tracking updates streamline fulfillment while keeping everything compliant with Amazon’s strict standards.

- Product tracking dashboards help you observe performance, analyze patterns, and decide which niche variations to double down on.

Illustrative flow: after importing a “cat deshedding brush XL,” set a starter price, enable 10% undercut rule with a floor margin, auto-sync stock, and enable auto-ordering. If the supplier runs out, AutoDS will pause the listing and notify you, preventing oversells and bad metrics. If the item sells well, scale price rules or import sibling variants with the same template.

In simple terms, you do the strategic thinking, and AutoDS takes care of the repetitive tasks. It keeps your research process smooth, your listings accurate, and your operation running without constant manual work.

👀 Still need a reason to try it? Make product research and fulfillment feel effortless — start your AutoDS trial for just $1.

Best Trending Niches on Amazon in 2026

Here’s one key thing to keep in mind: Amazon’s top-performing niches are rarely random. They come from clear behavior shifts: people spending more time at home, discovering new hobbies, reorganizing their space, or upgrading small parts of their daily routine. The good news? These shifts leave patterns, and patterns leave opportunities.

Below are high-intent Amazon niches that show consistent demand going into 2026. Each one is beginner-friendly, resilient to seasonality (unless stated), and strong in search volume.

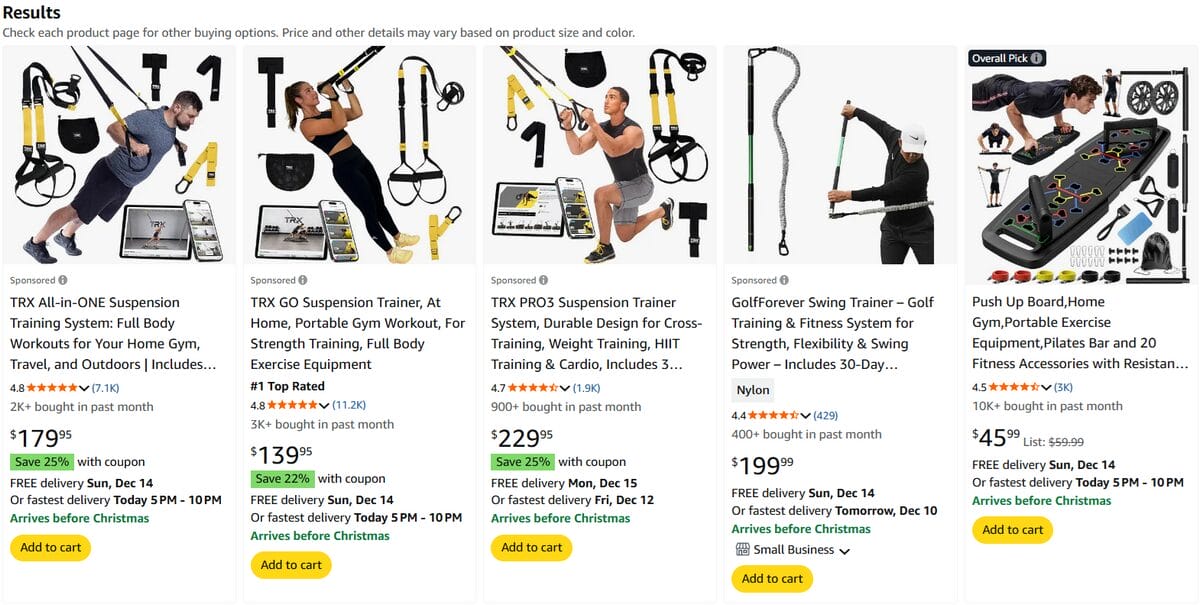

⭐ Home Fitness Accessories

Consumers continue to build “micro-gyms” at home, prioritizing compact, low-cost equipment that doesn’t require a full workout room. Resistance bands, ankle weights, foam rollers, and adjustable jump ropes lead the pack. Search demand remains steady throughout the year, and competition is moderate, making it great for beginners.

Avoid bulky items with high FBA fees, like large weights or full racks. Stick to compact gear and source from suppliers known for durable materials.

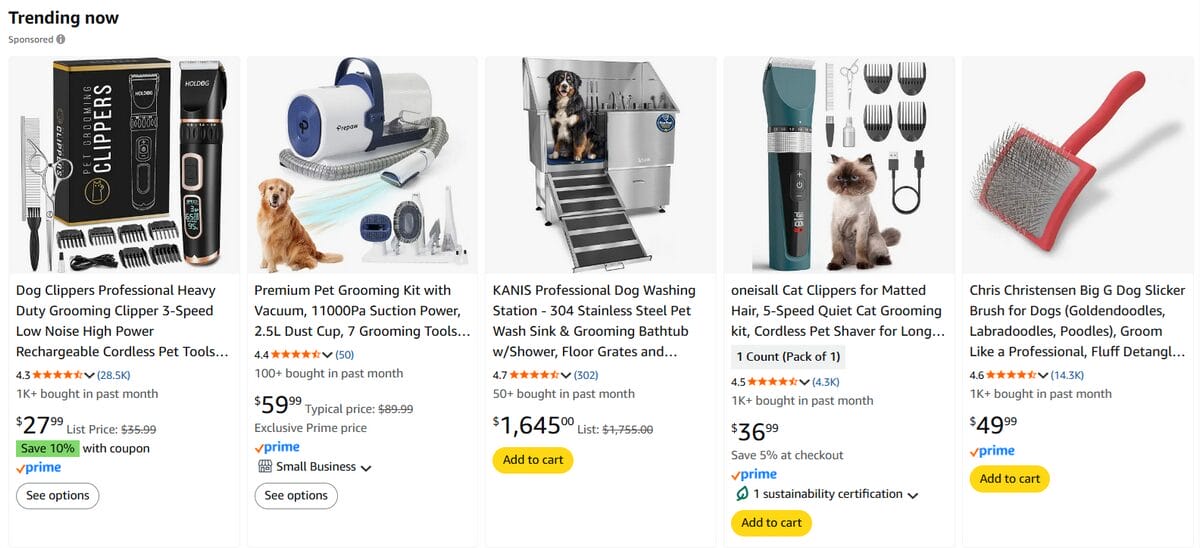

⭐ Pet Grooming & Enrichment Products

Pet spending is recession-resistant, and grooming tools (deshedding brushes, paw cleaners, silicone bathing gloves) are trending thanks to viral TikTok pet-care routines. Enrichment toys like snuffle mats and lick pads also show strong repeat searches.

Avoid cheap plastic tools that break quickly; grooming products need quality to maintain ratings. Choose suppliers offering tested materials and steady stock availability for repeat customers.

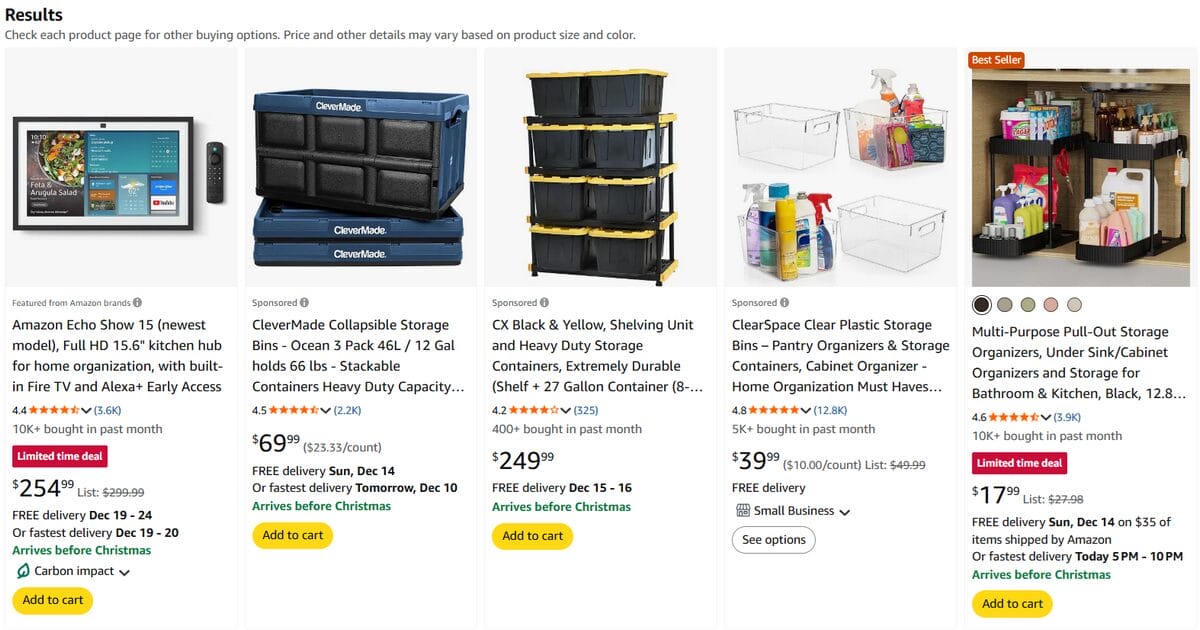

⭐ Home Organization & Storage

People are still on the “organize everything” wave. Drawer dividers, under-sink organizers, fridge bins, and foldable fabric boxes are among the top products featured in this niche. The demand remains stable because new customers enter the category every day.

Avoid over-complicated sets or fragile acrylic that cracks during shipping. Better sources: US warehouses (AutoDS Marketplace), providing reliable packaging and clear material specifications so shoppers know exactly what they’re getting.

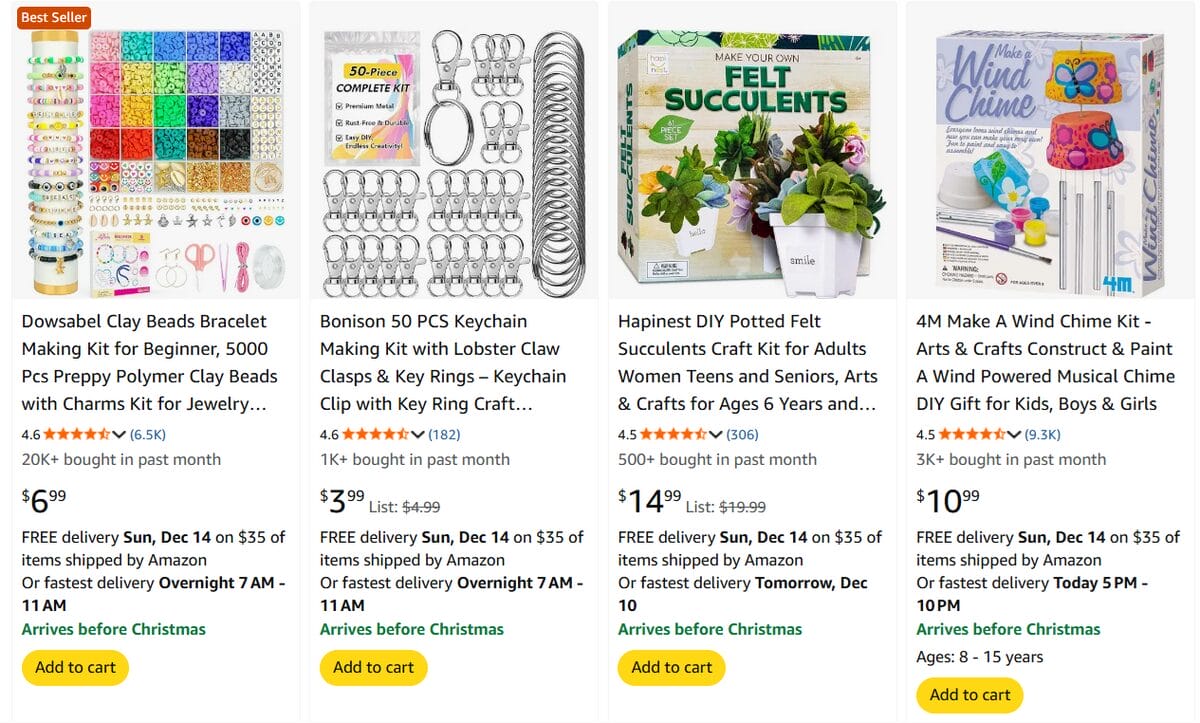

⭐ Crafting & DIY Micro Niches

Small crafting tools (needle felting kits, polymer clay tools, scrapbooking accessories) are booming thanks to TikTok and Pinterest tutorials. These niches thrive on creativity, meaning low competition and evergreen demand.

Avoid paints, resins, or liquids: shipping them complicates everything. Stick with tools and accessories. Supplier picks: AliExpress crafts category, Etsy wholesalers, and CJDropshipping craft lines.

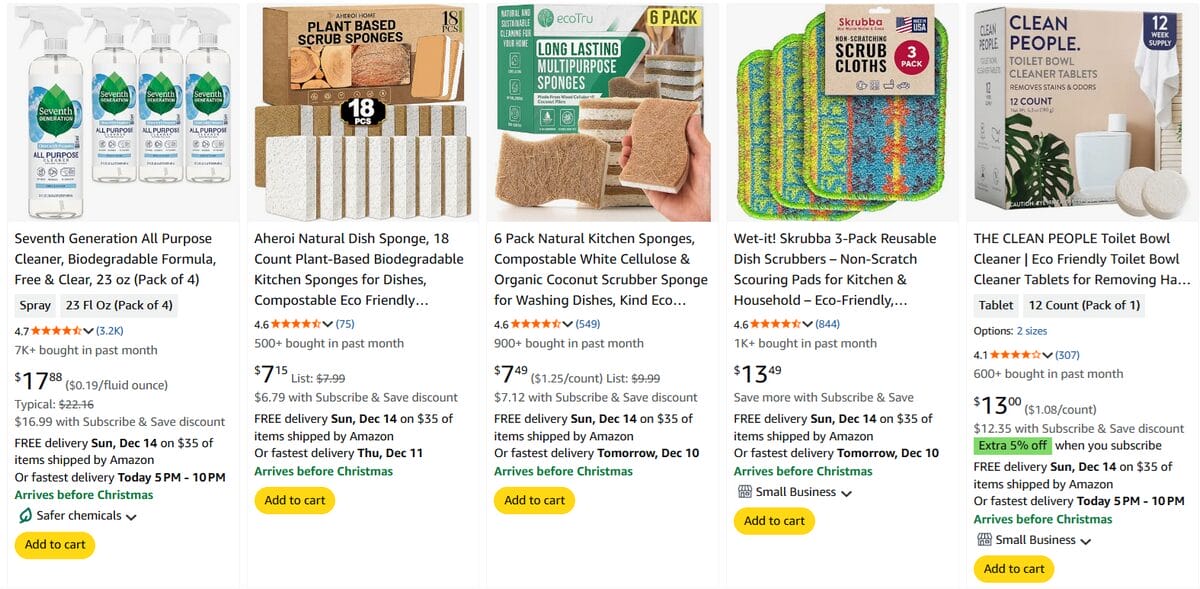

⭐ Eco-Friendly Household Alternatives

Consumers continue swapping disposables for reusables: beeswax wraps, reusable paper towels, stainless-steel clips, silicone zip bags. Searches rise annually as sustainability becomes a default expectation.

Avoid gimmicky eco-products with no real use (e.g., poorly sealing “eco containers”). Source products from reputable brands on AutoDS Marketplace, featuring high-quality and reusable materials with verified durability.

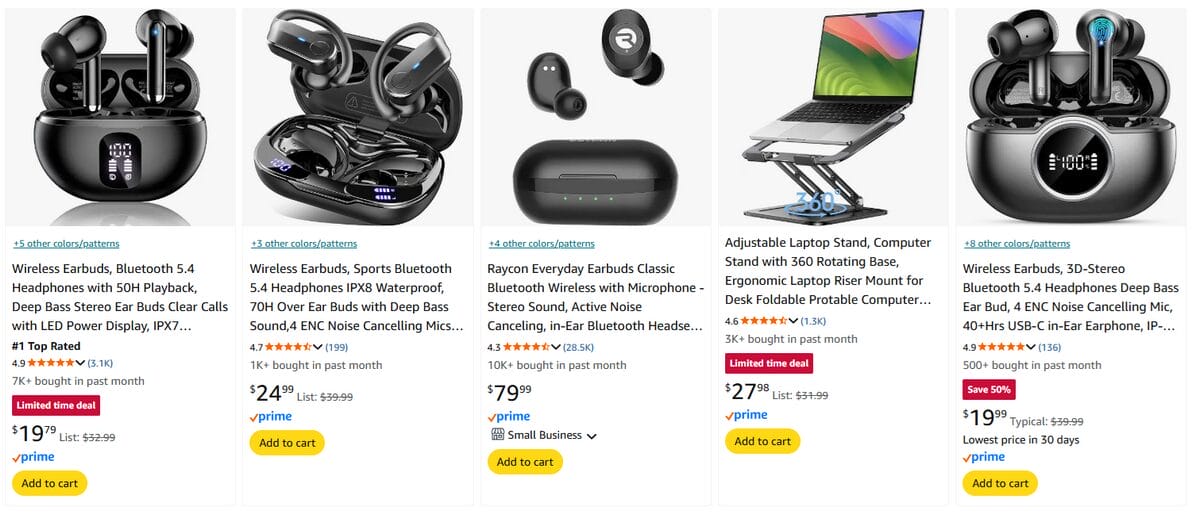

⭐ Phone & Laptop Accessories

A classic evergreen niche. Earbuds, laptop stands, webcam covers, and cable-management kits: these items trend because they’re cheap, frequently upgraded, and universally needed.

Note: demand spikes around back-to-school and holidays. Avoid low-quality cables or anything requiring certifications (like charging bricks). Focus on accessories, not electronics.

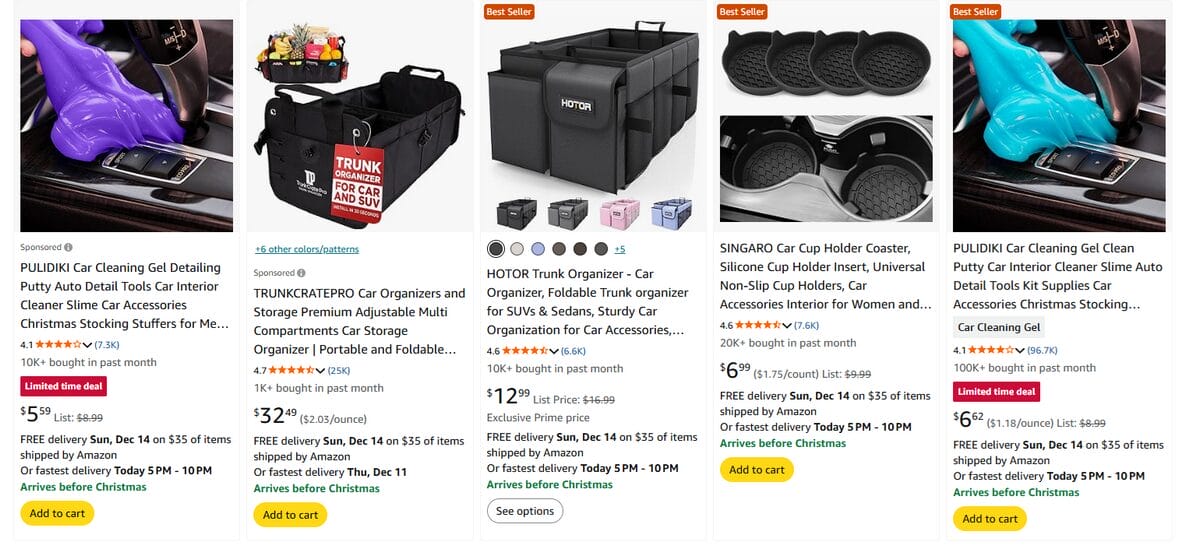

⭐ Car Interior Accessories

Drivers love affordable upgrades: trunk organizers, seat-gap fillers, steering-wheel covers, and screen protectors for car dashboards. These products trend because they’re universal, inexpensive, and solve micro-problems.

Avoid products requiring fit-specific compatibility unless you want returns. Stick with essential items.

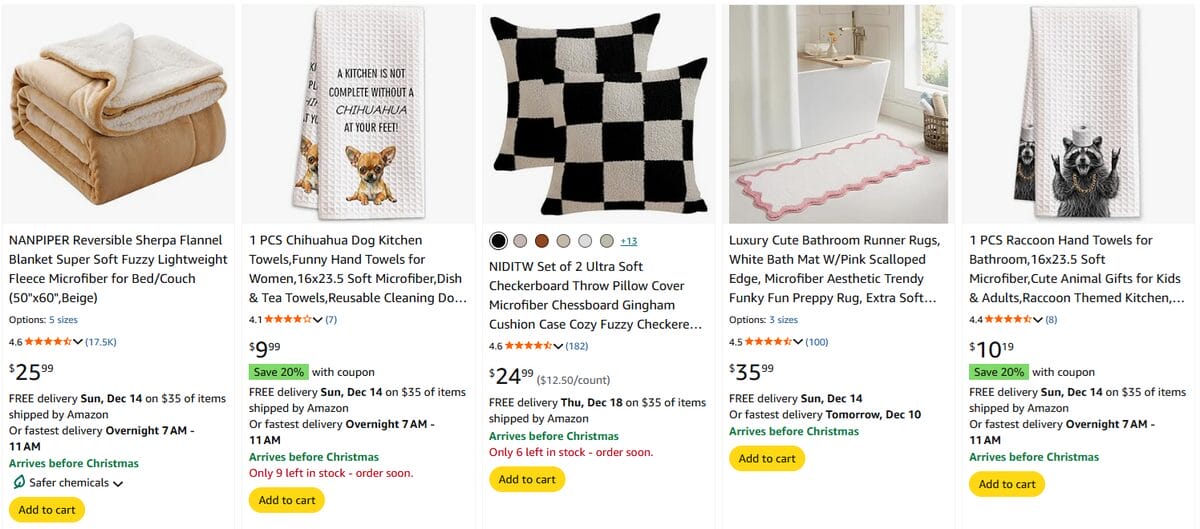

⭐ Home Décor Micro-Trends

Micro-aesthetics continue dominating Amazon: neutral vases, macramé pieces, wood-tone décor, minimalist wall art, and woven baskets. These products go viral on social media and have a low manufacturing cost.

Avoid fragile ceramics, oversized wall art (high shipping cost), and glass-heavy products. Better suppliers: home décor stores with strong packaging reviews.

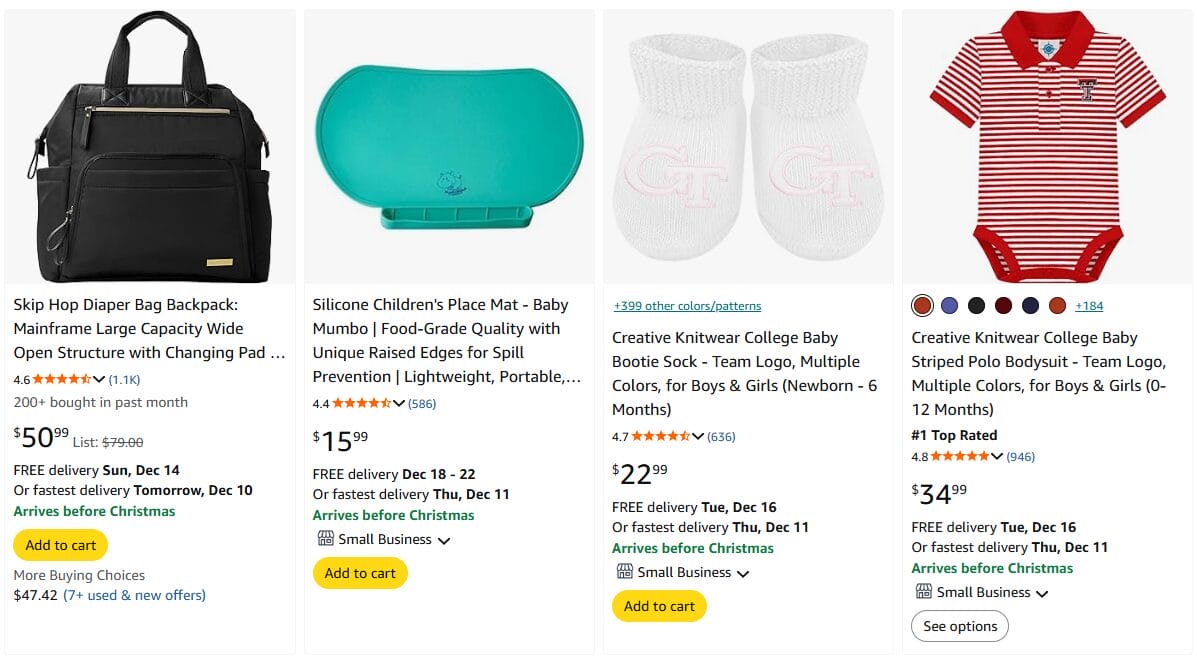

⭐ Baby Essentials (Non-Electronic)

Parents look for practical, safe, non-tech essentials: silicone feeding sets, muslin blankets, stroller organizers, and pacifier cases. These items trend because they’re universal and not affected by electronics safety regulations.

Avoid anything with batteries or electronics due to compliance issues. Look for suppliers offering BPA-free, food-grade materials and stable, long-term availability for parent-friendly reliability.

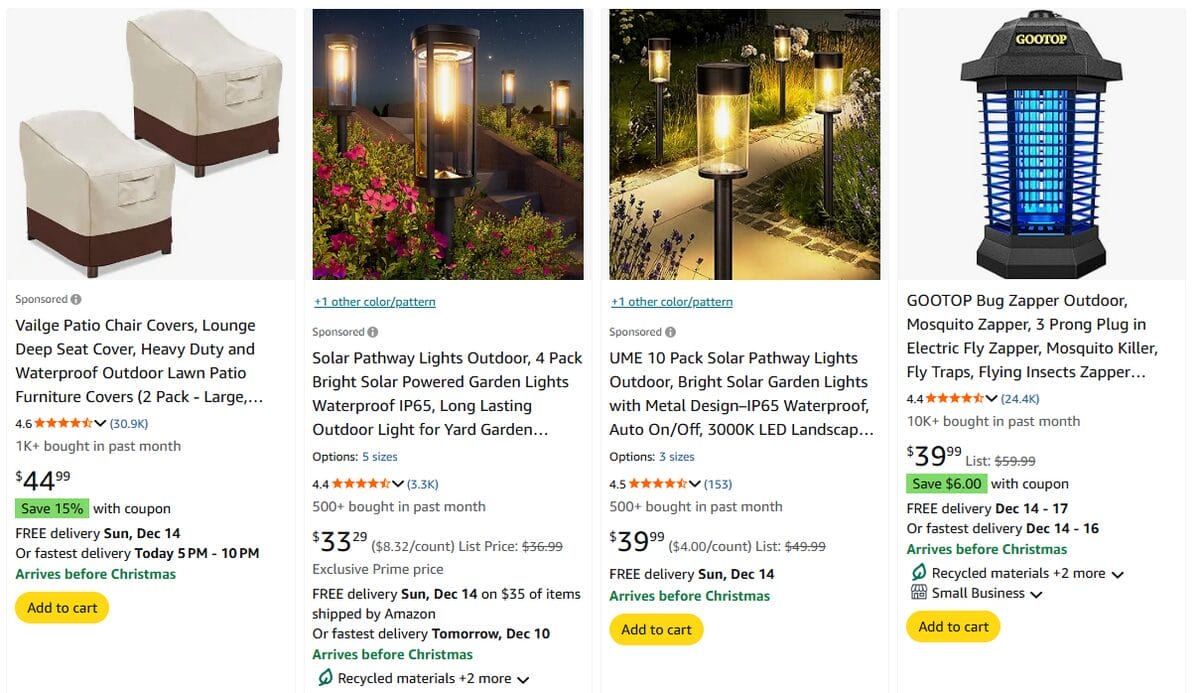

⭐ Outdoor Accessories & Seasonal Add-Ons

Outdoor home accessories, like weather-resistant cushions, solar pathway lights, patio organizers, small décor accents, or waterproof furniture covers, keep trending as people upgrade balconies, patios, and gardens. These items are lightweight, easy to ship, and follow predictable seasonal waves (spring/summer), which makes niche planning much simpler.

Avoid bulky furniture, fragile décor, or anything with oversized packaging that kills margins. For this category, look for suppliers with stable warm-season inventory and consistent restocks so you don’t run into gaps during peak demand.

Common Mistakes People Make in Amazon Product Research

Even with the right tools and a solid workflow, many sellers still fall into predictable traps that quietly sabotage their results. These mistakes are extremely common, especially when excitement kicks in, and people rush into a niche without slowing down to validate the basics. Before you move forward, here are the pitfalls you definitely want to avoid:

🚨 Picking saturated categories: high demand often hides brutal competition. If every listing has thousands of reviews and polished A+ content, be aware: you’re not stepping into an opportunity, you’re stepping into a traffic jam.

🚨 Ignoring shipping costs: a product might look profitable until dimensional weight, packaging fees, or FBA surcharges crush your margin. Always run the full math, not just retail vs. supplier cost.

🚨 Choosing products with poor supplier consistency: unreliable stock levels, slow delivery windows, and fluctuating supplier prices can wreck your Amazon metrics. Stability matters just as much as demand.

🚨 Not checking patent/IP issues: many “generic-looking” items are actually protected by design patents or trademarks. Selling one by mistake can lead to takedowns, warnings, or worse, account restrictions.

🚨 Relying on intuition instead of data: what feels like a great idea isn’t always backed by search interest or competitive room. Trends on Amazon don’t follow gut instinct: they follow numbers.

🚨 Ignoring seasonality: a niche can look amazing in one month and then flatline the next. Without understanding seasonal patterns, you risk building listings that only perform a few weeks a year.

Advanced Product Research Tips

Once you’ve mastered the basics, Amazon product research becomes less about chasing isolated winners and more about building systems that consistently uncover profitable gaps. These advanced tactics help you think like a strategist instead of a guesser, giving you an edge in categories where most sellers just copy what already exists.

✅ Create smart bundles: don’t just sell a stand-alone item. Combine complementary products that solve a bigger need (e.g., “desk organizer” + “cable clips”). Bundles boost perceived value, reduce direct competition, and often justify premium pricing.

✅ Use “niche layering”: stack multiple sub-niches together to target a narrower (but more intentional) audience. Think “boho baby room decor” or “eco-friendly car interior cleaning.” The smaller the overlap, the lower the competition, and the higher the conversion rate.

✅ Target gaps in competitor listings: weak photos, missing lifestyle shots, unclear benefits, and keyword gaps are golden opportunities. If the competition isn’t fully optimized, you can outperform them simply by building a sharper listing.

✅ Prioritize “problem-solver” items: products that solve a clear irritation, inconvenience, or pain point consistently outperform generic items. Anything that saves time, reduces effort, or solves a recurring issue tends to convert above average.

✅ Build niche authority, not random product catalogs: instead of jumping between unrelated categories, go deeper within one niche. This improves keyword relevance, customer trust, cross-selling potential, and your ability to scale.

✅ Use AutoDS to test multiple products at once: instead of betting everything on one idea, import several variations, track their performance automatically, and let data show which niche angle works best. AutoDS handles price/stock changes, fulfillment, and tracking, so you can run controlled experiments smoothly.

These moves turn product research from a guessing game into a repeatable, scalable engine for niche discovery, exactly what modern Amazon success is built on.

Frequently Asked Questions

How do I do product research for Amazon?

Product research on Amazon means analyzing demand, competition, margins, and supplier reliability. You look at search data, competitor listings, and profitability signals to filter real opportunities. AutoDS simplifies this by turning scattered data into clear insights.

What are trending niches on Amazon in 2026?

Trending niches are categories showing rising demand, growing search volume, and early momentum before they go mainstream. They often emerge from lifestyle shifts, social media influence, or seasonal peaks. Sellers win by spotting these patterns early and validating them with data.

Which tools are best for Amazon product research?

The best tools combine demand insights, competition analysis, and profitability metrics. AutoDS streamlines research with real-time product data and multiple features, while Amazon’s native tools and third-party platforms add deeper validation. Nonetheless, AutoDS offers time-saving automation that others can’t.

What is the most profitable niche on Amazon?

There isn’t a single “most profitable” niche. It depends on margins, competition, supplier reliability, and demand stability. That said, niches like pet grooming, home fitness accessories, eco-friendly household products, and car interior accessories consistently perform well because they blend evergreen demand with manageable competition.

How do I check if an Amazon niche is too competitive?

To check if an Amazon niche is too competitive, look at review counts, listing quality, brand dominance, and pricing pressure. If top listings have thousands of reviews, perfect optimization, and stable pricing, the niche is heavily defended. You want openings (weak photos, missing keywords, or inconsistent pricing) because those indicate realistic entry points.

What is BSR and how do I use it for product research?

BSR (Best Sellers Rank) shows how well a product sells in its category in Amazon. Lower BSR means higher sales velocity. You can use it to compare products within a niche, track trend momentum, and identify categories with rising demand. Sharp BSR drops often signal emerging opportunities.

How do I know if a product will sell well on Amazon?

To know if a product will sell well on Amazon, look for search demand, low-to-moderate competition, healthy margins, and strong supplier consistency. When these signals align, the probability of success rises. AutoDS validates these elements using real-time data and listing performance trends.

How do I find low-competition products on Amazon?

To find low-competition products on Amazon, target listings with under 500 reviews, weak optimization, inconsistent pricing, or missing keywords. These gaps signal that buyers are active, but sellers aren’t optimized. That’s exactly where newcomers can enter and outperform.

How do I research Amazon products for dropshipping?

Researching Amazon products for dropshipping means finding items with fast shipping, lightweight dimensions, stable demand, and reliable suppliers. AutoDS helps by offering a whole set of product-finding tools and one-click importing, so you can validate, test, and list products quickly.

How does AutoDS help with Amazon product research?

AutoDS analyzes product trends, checks competition signals, tracks performance, and automates importing, pricing, and stock monitoring. It turns the entire research workflow into a streamlined process where testing multiple products becomes fast and predictable.

How long does it take to find a winning product?

It can take anywhere from hours to days or even weeks, depending on the number of niches and products you test, as well as the strategy you employ. AutoDS shortens this cycle by automating product discovery, tracking, and testing, letting you evaluate multiple candidates simultaneously without adding manual workload in minutes.

Should beginners start with niches or with individual products?

Beginners don’t need to choose one path immediately. A practical strategy is starting with individual products to learn validation, testing, and optimization, then expanding into niches once patterns emerge. This way, you use early wins to guide niche discovery that leads to long-term demand and multiple product angles.

Start Your Dropshipping Journey with AutoDS

By now, you’ve seen how Amazon product research moves far beyond “finding something that looks cool.” It’s about spotting demand curves, reading competitor gaps, filtering by profitability, and understanding how niches behave over time. When you combine solid research habits with the right automations, you stop guessing and start building a store with real momentum.

That’s where AutoDS enters the picture: it gives you the tools, data visibility, and rapid product testing workflow that manual research simply can’t match. Simply put, AutoDS breaks the research barrier that holds sellers back, turning hesitation into action and action into scalable results. That’s the difference between sellers who get lucky once… and sellers who build something that lasts.

And with high-demand niches emerging and new gaps appearing in Amazon listings every week, early adopters get the advantage. So, what are you waiting for?

🚀 Try the 14-day AutoDS trial for just $1 to find Amazon products that actually sell—and start building your competitive edge today.

Want to push your skills further? The following articles will walk you through more dropshipping tactics and insights: